How to get Yourself Paid: Prioritizing your Worth as a Business Owner

For business owners who are running businesses under 10 years old (and sometimes later!), one thing I’ve observed is that their compensation often gets left out of the overall business plan. I’ve also seen overpaid owners which can be equally devastating. Today I want to talk about WHY it’s important to pay yourself as an owner. HOW to think through WHAT to pay yourself and a few next steps to get you to your goal.

Owner pay is directly related to your business health.

I believe that when you start a business, you should be thinking about what you’re going to do with the business in the end. Often owners wait until they are tired of running the business and think they can sell it in a few months - that is NOT true. You need to plan for the next 3-5 years, and it’s something you should be thinking about the moment you start. Your pay as an owner is calculated in the value of your business. If you aren’t getting paid at all, and you're a key employee you’re skewing your financial statements. Even if you aren’t a key employee, the new buyer needs to know what they can expect to get out of the business (i.e. recurring cash flow). If you aren’t taking any owner’s draws - then there is likely limited value in the business. You may still sell but for a much lower price.

You need to take care of yourself financially: a healthy you = a healthy business!

When was the last time you thought about your personal goals? Do you know how much you need to make to run your life? Do you know how much you WANT to make to reach your financial goals and your lifestyle goals? Are you constantly feeling like you're broke?

Follow along for a quick exercise:

Take a minute or two and write down how much $ you NEED to make every month. Is that $5K or $10K. Are you making that right now? HINT: create a personal budget.

Take another minute or two and write down what you WANT to make. Do you want to be able to go on two vacations a year? Renovate your house? Write down that number. Are you making that number?

Last, take some time to write down your financial DREAMS. What do the next 5, 10, 15 years look like and what do you want to accomplish? Are you saving up for a private island? What do you need to do to make that happen?

Let this sink in:

Your personal needs and wants MUST be your business NEEDS.

If you NEED to make $10K per month, and minimum your business needs to be able to pay you that amount. You need to figure out how much revenue your business needs to make to pay you that amount.

This is the best way to set your future up for success.

What can your business pay you?

The third piece of the puzzle is determining how much your business can pay you right now.

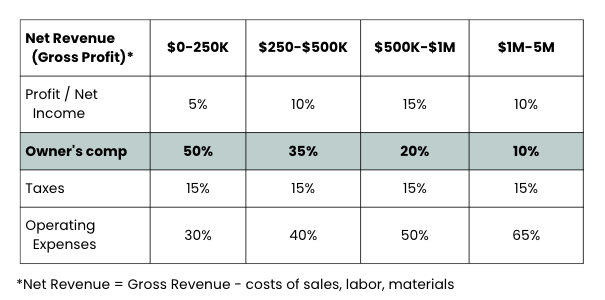

I like this table from Profit First to use as a starting point:

By looking at this what you’re doing is saying;

Revenue is $X

Costs directly related to Revenue are $Y

My “REAL Revenue” or Net Revenue is $Z (equal to net revenue in the table above)

My income should be B% of $Z based on my revenue size.

Compare that to what your personal needs and wants are and understand what you need to do to either increase your income or bring it back down to keep the business healthy.

Here are some examples :

Your current pay is too low to meet your personal goals:

Your Real Revenue or Net Revenue is $100K per year

You can pay yourself $50K a year to keep the business running smoothly

You NEED to be making $65K per year.

You need to work to increase your Real Revenue or Net Revenue to $130K per year.

Your current pay is to HIGH to keep your business running smoothly:

Your Real Revenue or Net Revenue is $100K per year

You are paying yourself $90K per year

You have no $$ leftover to invest in the future growth of your business.

You need to work on increasing your real revenue or net revenue to $180K per year or you need to decrease your personal income to $50K

These are super simple examples using $100K because it makes for easy math. But this can be applied to any revenue size and but notice in the table above that % of owner pay changes as the revenue increases in your business.

Business models and industries vary in how much you can pay yourself:

The other thing I want to note is that each business model has slightly different needs. There are several that you can pay yourself $90K per year out of $100K per year if you have low overhead, think of realtors, solopreneurs, and independent contractors. That’s not unreasonable in certain circumstances, but if you have a team and are growing then you need to think carefully about that.

A great exercise, that should be taken with a grain of salt, is benchmarking. This can help show you how other business types in your industry spend their money.

side note on benchmarking - it’s a great tool to see how you compare to other businesses in your same industry, but there are some drawbacks.. It can anchor you to a false standard of success that either you are more than capable of outperforming or doesn’t exactly apply because there isn’t enough data for your specific business model.

You need to pay yourself SOMETHING!

Please take this away, if nothing else- your business NEEDs to pay your at least some $$.

If you are doing ANY work in the business, you should be paid at LEAST the rate you would pay someone else to do the same work. For example, if you’re doing all your social media and the average rate for that work is $20/hr, at LEAST pay yourself that.

I’ve worked with founders who say “I’m not motivated by money” but here’s the thing: everyone is motivated to grow their business and take care of their loved ones. Money is a tool used to do these things. You cannot take care of other people if you don’t have money. Don’t pay yourself ZERO.

But what if you’re not doing any work in your business?

Well, you’re an owner, and business owners should also be paid. How and when and how much may vary. If the only part of your business owner role is to review financial statements once a month to see how things are going, then you're likely getting a recurring dividend quarterly or annually based on your % of ownership. And you should be! But you still need to be paid something. It gives you skin in the game to course-correct when things go south and to continue to make your business work for you.

There are so many things that can cause business failure. I believe the most overlooked one is a burnt-out owner. Owners can get burnt out for so many reasons and owner pay is just one piece of the puzzle. Don’t skimp on paying yourself and expect to be fully invested after 5 years of little to no pay. Work harder to create a business that aligns with your personal needs and wants and your long-term life goals. Money is a great motivator (in a GOOD WAY) and understanding and applying that to your compensation from your business is just as valuable as the ways you work hard to keep your employees engaged and active.

How have you thought about your owner's pay? I’d love to hear from you! Natalie@copper8strategies.com